Donors are your nonprofit’s greatest resource. The Q2 2022 Fundraising Effectiveness Project paints a concerning picture. From January to June 2022, the number of donors declined by 7%, and overall donor retention decreased by 4.2% year over year. Additionally, retention rates for first-time donors declined from 25.3% in 2016 to 19.3% in 2020, according to nonprofit organizations surveyed by the Association for Fundraising Professionals.

A donor acquisition strategy is essential to every nonprofit’s sustainability because adding new donors to the file will offset donor attrition and provide a new pipeline for future major donors. As we’ll talk about below, donor acquisition direct mail is a long-term investment to grow your donor file and revenue over time, and you need a multi-year view of the outcome.

This article provides insight and perspectives on donor acquisition strategies for direct mail. It should be noted that direct mail is just one channel to acquire new donors. A robust fundraising program should use all available channels to acquire, renew and retain donors.

Acquiring new donors is challenging, but our team is well-equipped to get the job done.

Set your acquisition goals and budget.

A deep-dive analysis of your current donor database is the first step you’ll need to take. We recommend you start with these 7 Key Database Metrics.

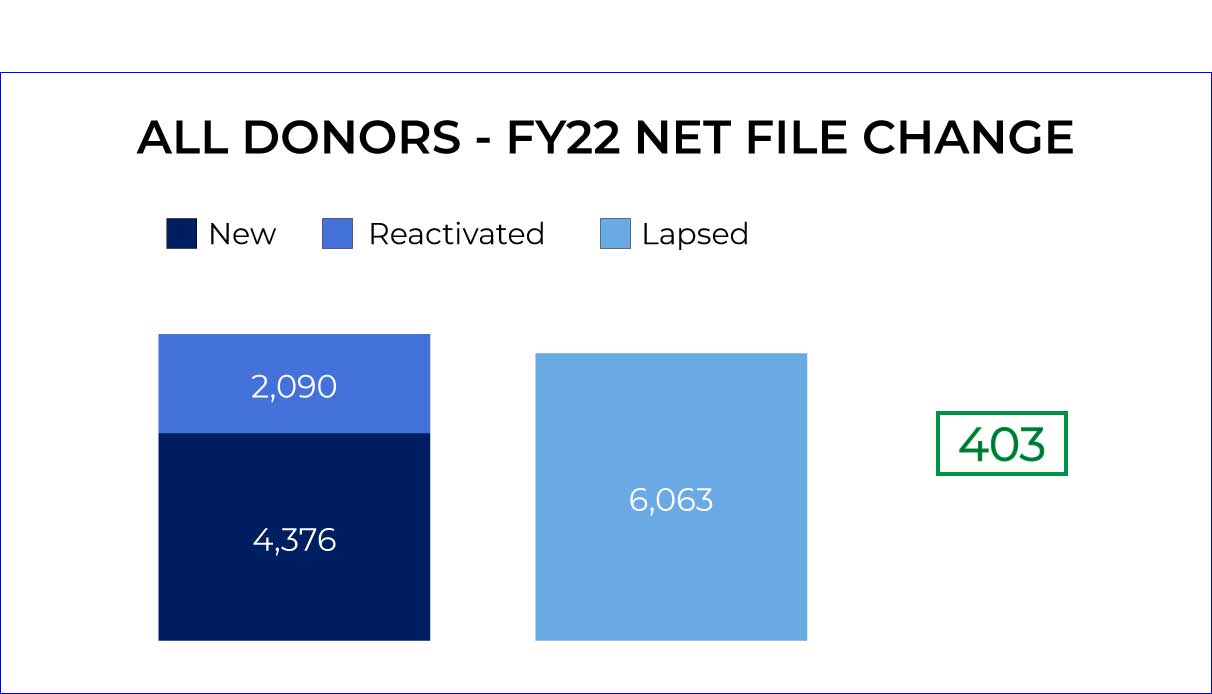

At the most basic level, the goal is to understand if your donor base is growing or shrinking and how many new donors you will need to acquire each year to offset any projected attrition.

This essential information will allow you to precisely set your donor targets and properly budget for acquisition activities.

The cost of donor acquisition

Typically, acquisition campaigns will result in an initial net loss because the cost to acquire a new donor (list rental, creative, production, and postage) is greater than the amount of the new donor’s first gift. But this should not be a reason to reduce or eliminate donor acquisition efforts. You can’t grow your program through cost-cutting. New donor acquisition is an investment in your organization’s future. As most nonprofits won’t achieve breakeven until year two, it’s important to have a robust fundraising program in place – one that encourages the new donor to make a second gift as quickly as possible and ultimately become a loyal, multi-year donor.

Campaign KPIs to monitor include:

- The number of new donors acquired

- The net cost to acquire a new donor

Direct mail acquisition cost varies significantly by nonprofit sector and the type of mail program (using a premium vs. not, for example).

When planning an acquisition campaign, you should project revenue for the first gift and subsequent year giving.

The slide below shows two important things:

- The first-year value of a new donor acquired in FY18 was $89. Compare this to the cost to acquire. If it’s less than $89, these new donors paid for themselves in the year they were acquired.

- The cumulative revenue of the donors acquired in the “class of FY18” is over $1.1 million. These are the types of metrics you can share to help make the case for the much-needed investment in acquisition.

Once you have completed a donor acquisition campaign, you will use that cost to acquire as a benchmark metric to get the most donors for the least cost in subsequent campaigns. The acquisition cost can improve over time as you test creative, offers, and audiences to hone in on the best-performing combination.

Dispelling Common Myths

The three most common myths about direct mail acquisition are:

- You should expect a 1% response rate.

- Adding wealth data to your prospect file will result in a more successful campaign.

- Mailing to the most affluent zip codes will result in a higher response rate.

As mentioned above, acquisition response rates vary greatly depending on the type of nonprofit, the offer (premium vs. non-premium), brand awareness, and if you have a mature fundraising program or one just getting off the ground. Working with a professional fundraising agency with experience in your industry sector can help you set realistic expectations.

Find new donors that look like your existing donors.

Understanding your target audience starts with knowing your loyal followers. The more accurate your targeting, the less attrition you will have. You’ll recruit better donors who will stay on file longer.

A list model is a potent tool many organizations use to find new donors, and it’s often much easier and cheaper than most organizations realize. A modeled list is built using actual donor data from your organization and others to attempt to predict giving behavior. A modeled list uses the demographics of responders versus non-responders, like age, income, presence of children, et cetera, to see which is the most predictive of the response in the giving behavior we’re trying to replicate with the model.

The best sources of new donors are organizations with missions that are similar or aligned with yours. Who else serves the same (or similar) cause that your organization does? Average gift statistics help you assess which organizations’ donors give larger gifts typically.

You might be surprised to learn that wealth is not typically an indicator of propensity to give – especially in a direct mail program where the initial gifts tend to be more modest. Wealth data certainly has its place, but it’s best used in developing Mid-Level, Major Donor, and Planned Giving programs. The prospects most likely to give to your direct mail acquisition campaign are those with a history of giving to similar organizations and those with a history of taking action via the direct mail channel.

Beyond nonprofit audience donors, publications or catalogs should be scrutinized to identify ones that attract your target demographic. Pay attention to the average unit of sale. While there isn’t a direct correlation between the ability to give and the propensity to give, it is an indicator of their spending comfort level.

Need help dissecting and leveraging your donor data?

Acquisition lists can work for your organization.

Whether you purchase a compiled list or a more expensive response acquisition list, how you process your list can impact the success of your mailing. As you develop your acquisition strategy, be careful not to overlook donors. Review your donor file for counterproductive over-suppression.

Suppression file criteria aren’t sexy or cutting-edge. But proper use of these criteria is an essential tool and building block of a healthy new donor acquisition program.

All acquisition programs should suppress these two key segments of donors:

- Active donors you already communicate with as part of a renewal or additional gift program

- Lapsed donors you plan to communicate with again soon

(Note: You should also suppress your internal Do Not Mail lists, but they may or may not be donors, they could also include your board, major donors, and those who fall into another track.)

Reactivate lapsed donors to increase your donor file.

If you have a large portion of your lapsed file that you are not planning to try and recapture via the mail, you should NOT suppress them from acquisition mailings.

After a certain amount of time, people forget they gave to you. So, they should be placed back in the acquisition funnel and treated as new prospects. Also, the fact that these long-lapsed donors are actively giving to other organizations indicates that they may respond favorably to your appeal.

Updating your suppression file criteria to avoid over-suppressing will increase the available universe for your acquisition mail. We recently went through this process with a client with a mature acquisition program that was having trouble hitting its target mail quantity. We tightened up the suppression criteria, and the client hit their goal quantity in acquisition for the first time in a long while.

Want to boost retention for all communication channels? Explore these 31 strategies.

Accurately remove people who won’t or can’t respond.

Existing donors are not the only people who should be suppressed from your acquisition mail. A data-processing specialist provides access to valuable resources to ensure that you are mailing to people who are at a current physical address, want to receive your fundraising letter, and can read your message.

- NCOA (National Change of Address) provides standardized and current addresses on all input and suppression files, which helps accurate matches between files, yielding a deliverable and duplicate-free mail file. NCOA also allows you to remove any donors who have moved outside your service or mailing area and update any new addresses in your database.

- Use the National Do Not Mail and the prison lists to suppress people who have expressed that they don’t want to be solicited via the mail and people who are in prison and do not have the means to support your mission.

- When was the last time you bumped your donor file against a database of deceased individuals to remove them from your file? If you haven’t given that much thought, chances are your rental list owners haven’t either! Deceased individuals do not make gifts.

Focus your donor acquisition mail efforts in the right location.

Location is everything. Your fundraising efforts are limited to the size of your service area, but that doesn’t mean you should include your entire service area in your donor acquisition mail efforts. The cost of direct mail—particularly new donor acquisition—is too high not to give some serious thought—before mailing—to where your investment should be directed.

Knowing where your existing donors live is critical. Heavy donor presence in an area indicates that your brand is strong there and that the demographics of the area’s population match those of your current donors. Hold ZIP Codes that have historically been a part of your donor acquisition mailing program to a higher standard than ZIP Codes you have never mailed.

Be careful not to look at gross numbers of current donors by ZIP Code. Calculate a penetration level for each ZIP Code—the percentage of households your donors represent to compare ZIP Code value accurately. You can see that two ZIP Codes with the same number of donors look very different when you look at them from the proper perspective.

ZIP Code 12345: 50 donors / 5,000 households = 1.00% penetration

ZIP Code 12346: 50 donors / 15,000 households = 0.33% penetration

If you’ve achieved a respectable donor penetration level without mailing a ZIP Code, consider what your organization could achieve if you invited people to give! By the same token, if you have been mailing a ZIP Code for years and haven’t gained any real traction there, it’s time to give up and remove them from your costly acquisition mail efforts.

5 Keys to a Successful Direct Mail Acquisition Program

- Set a new donor acquisition target enough to offset donor attrition.

- Utilize all available channels to acquire new donors – knowing that direct mail is still many organizations’ primary source of new donors.

- Know your numbers – including the net cost to acquire a donor, the number of new donors acquired, second-year and multi-year retention rates, and revenue per donor.

- Set realistic expectations – results vary greatly depending on the type of organization, offer, brand awareness, etc.

- The mailing list you use will have the most significant impact on the success or failure of your campaign. Seek the guidance of a professional.